A few of our clients are, with our help, undertaking major drives to further professionalise their Business Development and Pitching processes. Here we share some of our general thinking around the subject, for all of our clients.

We have written an extensive paper with some new diagrams to capture some of our latest thinking and IP on these subjects. It builds upon the work we have done over more than 25 years of helping clients with their Business Development. The paper is now on our website and this article squeezes out some of the highlights for you.

Our goal when starting the review was to capture a lot of thoughts, so that we could develop further our own advice in this key area, and create a set of segments that our clients could choose from as pertinent to their own goals.

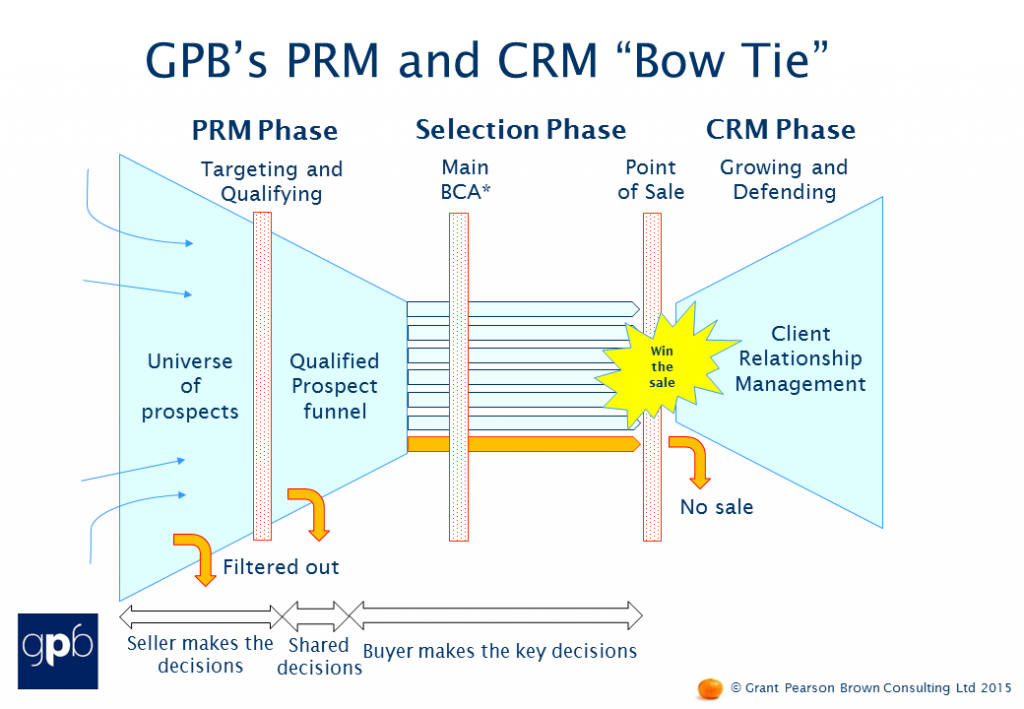

The GPB “Bow Tie” of PRM and CRM

We used to show the PRM and CRM (Prospect and Client Relationship Management) process as a diamond, it had the effort rising then falling either side of the Point of Sale. We’ve updated that; the diagram now captures the filtering down of prospect lists as qualifying and targeting reduces the numbers in the pipeline. Conveniently it looks like a bow tie.

It also captures our Buyers Criteria Analysis (BCA*). BCA starts early in the Selection Phase, an expanded middle phase between PRM and CRM where numbers of prospects do not change much, and effort is focussed on moving the prospect through the pipeline. In the CRM phase, the optimum effort and investment levels are shown, rising as the number of clients in this phase rises over time, and your client passes through the Growth and Defend stages.

It also shows the win rate % at the point of sale (a high % in this example), with wins in blue and ‘No sales’ in orange. It now also shows who is taking the decisions – initially the seller determines who to target and qualify, but post this filtering, the client is in charge of who they hire, more than the seller.

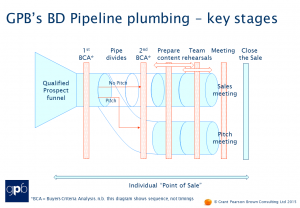

The GPB Pipeline plumbing

We have created this from scratch as a visual. It expands on the selection phase, and shows how the sales process can involve a pitch meeting or sales meeting.

We propose at least 2 rounds of Buyer Criteria Analysis (BCA) as we believe it is useful to repeat this exercise and not rely on one reading, with the second reading taken after the client’s decision to have a pitch or not.

Then it shows the timing of key stages when the strategy, team and content build occurs and then rehearsals for both sales meetings and pitch meetings.

We define an individual’s “Point of Sale” (iPoS) as that moment when an individual who has a say or vote in the buying decision makes their own personal decision.

This is usually done privately in a reflective moment, or whilst someone makes a key point, or whilst speaking on the subject. It may be at the pitch, or after the pitch and more rarely before the pitch. The most common of the three alternatives is after the pitch has occurred. The Blue arrow shows how the iPoS can occur at very different times; this will be a different moment for each person and each pitch. At the end of the process there is the corporate “Close the Sale”, at which a vote or discussion leads to a winner being chosen.

Buy side roles

The number of roles in buying entities varies a great deal, in this article we share some of the more typical ones we have found. The power of these roles varies, and is not normally the same for the ‘Yes’ and ‘No’ sides of a decision. An individual can have one or several roles.

These roles are allocated for each specific transaction, so can and will change from pitch to pitch. Bidders should not assume a role continues between (and even within) transactions without checking. Individuals in each role can have a wide variety and blend of motivations.

Buyers:

Payer – a Key Buyer, with strong Yes and No votes. These people control the budget but won’t have direct involvement in using the product or service

User – also a Key Buyer, with strong Yes and No votes. These people will use the service or product, so want to examine how it will work.

Partner – Key Influencers; have medium to strong votes, with largely equal Yes and No votes. They will usually be working alongside the winning bidder on the transaction.

Procurer – aka Admin/Logistics – also Key Influencers; strong ‘No’ vote, weaker ‘Yes’ vote. Usually process-driven, they can have elimination criteria that are exercised usually before the short-listing or decision moment, but unhelpfully can also alter decisions, after they are made by their seniors, by using elimination criteria (e.g. conflict of interest or reputational liability).

Other key client roles:

Insider – can be any of the Buyers, wants to help your firm win, and so optimal is a role as a Key Buyer. Best scenario is if they have high levels of internal access to valuable intelligence, and will supply this to you and coach you.

Outsider – not officially a Buyer per se but pulls the strings (influences strongly) behind the scenes. May be as senior as the Buyers (or more senior).

Antagoniser – can be any of the Buyers, the opposite of the Insider; there to help one or more of your competitors win, and will supply to valuable intelligence to them. Does not want you to win; often against you because of some prior work or relationship damage.

Overseer – usually someone more senior than the Key Buyer/s, there to see fair play. Can (but should not) have a strong Outsider influencer role, even a decisive one.

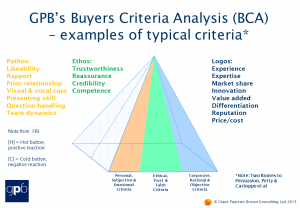

The Buyers Criteria Analysis (BCA) Pyramid

This pyramid is a new visual for us. It aims to capture a number of complex ideas which are best shown visually.

Types of Buyer Criteria

These are many, diverse and specific to the transaction and the buyers for that transaction. We define “Buyer’s Criteria” as the set of factors that a buyer uses to make a decision. It is helpful to try to categorise the criteria and to offer some general examples of these factors, to assist our clients to understand their enormous diversity.

We can cut Buyers’ Criteria in three ways:

Logos – Corporate, Rational, Objective and Quantifiable criteria (shown in blue).

Ethos – Ethical, Trustworthiness, and assessments of Competence and Credibility (shown in green).

Pathos – Personal, Subjective and Emotive criteria (shown in orange).

The relative dominance of these three factors varies greatly from person to person and also from pitch to pitch.

We can also see now where GPB’s Hot [H] and Cold [C] Buttons from our FBI diagram fit in here, as these cause positive or negative scores on the various criteria.

See the pyramid diagram below for examples of these criteria and where they usually fit, but please note that this is a simplification of a highly complex subject!

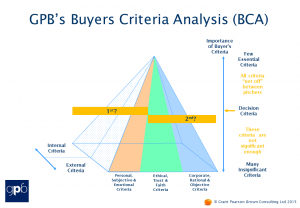

The pyramid shape shows how there is a ranking of significance for all criteria from a few key criteria that can be considered essential, through the decision level ones, down to many almost insignificant criteria.

All Buyers start at the top with the Essential Criteria. Their evaluations using this set of criteria nearly always net off to produce a draw. This moves the Decision Level down the pyramid.

The Decision Level criteria (shown as the horizontal orange bars below) are often where there are small but ultimately significant differences between sellers/pitchers; they are therefore the most critical criteria of all. They are used to select the winner of the business. They are the criteria that GPB has long referred to as “Factor 40”, as all the [39] factors above have all netted off against each other.

It is now known that decisions are usually first made for emotional reasons, and post-justified with rational and/or ethical explanations. This diagram illustrates this well (1st and 2nd orange bars). If that is so, you will usually never find out what the real reason for the decision is, unless you have a really good “S.I.D.”, a Senior Independent Director, who is external to the sale or pitch, but performs the client review process.

The pyramid also differentiates between Internal (private, within oneself) and External (shared, open) criteria; the weighting of these again can vary relative to each other. Internal criteria are processed inside someone’s head; they are important but private, and there will be few clues (e.g. from questions they ask you) about what those criteria are. The Internal criteria are usually dominant.

Buyers’ Options

Buyers may have at least the following options from which to choose:

(i) Choose one of the bidding/pitching firms – either an incumbent or “excumbent” (i.e. a new supplier, and a new word from GPB!)

(ii) D.I.Y. – doing the work themselves.

(iii) Do nothing – cancel the whole project and continue as before (unlikely where large investment of money, time and hassle has taken place, or where legal/regulatory requirements exist).

(iv) Do something as a standard (and possibly pre-existing) alternative with the budget/funding/money.

(v) Do something creative instead or as well – including those ideas provided by one or more bidder.

We trust this gives you some juicy ideas. This article will be followed by a further one in the next edition, covering more of our new ideas in the BD area.

By Ewan Pearson.